Ellen Carter stared at the screen, frozen. The CFO’s email had arrived while she was still in her damp robe, the toast forgotten on the counter. Three decades building Stratagrowth, guiding it from a garage with two folding chairs and a space heater to a publicly traded powerhouse, and now her pension was “temporarily suspended pending cost optimization review.” No greeting. No signature. No recognition of the work she’d poured into every merger, every crisis, every burned-out server and overbudget acquisition. Just a sterile HR auto-message, the kind that might as well have been written by a bot programmed to erase her existence.

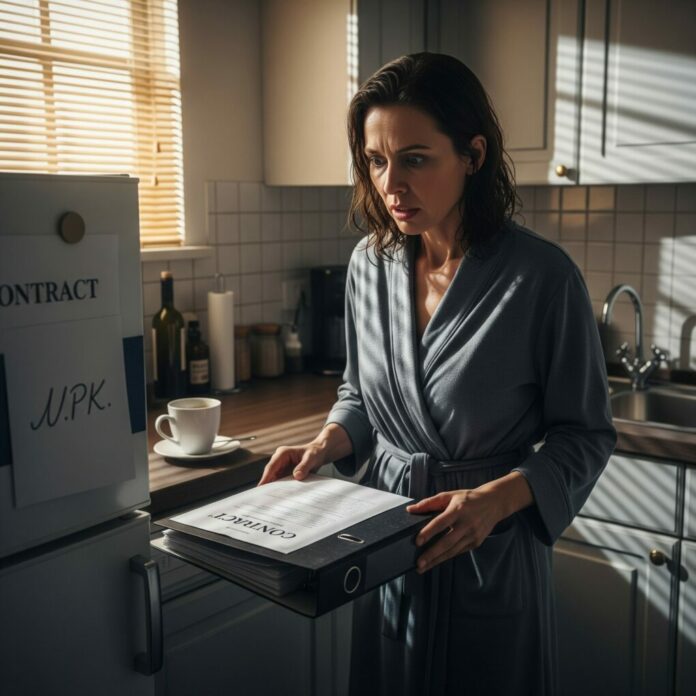

Her hands shook slightly as she opened the cabinet above the fridge, the one full of forgotten warranties and dusty binders. She pulled down a thick black binder labeled E. Carter Founding Docs. She flipped through incorporation filings, bylaws, and early equity splits. And then she found it: Clause 14D, buried in her original 1994 founders’ agreement.

“Any material adverse change to the employees’ compensation package shall trigger an immediate severance payout of $25 million USD, payable within 72 business hours.”

At the time, it had seemed absurd. Stratagrowth wasn’t worth that kind of money, not even close. But now, staring at the clause, initialed in blue ink beneath the board chair’s signature, Ellen understood its quiet power. She didn’t panic. She didn’t shout. She brewed a second cup of tea and calmly drafted an email to the legal team: Clause 14D activated.

Hours later, her lawyer Charles Rainer called. “Ellen, it’s still very active. No rescission, no amendments. They’re screwed if they ignore this.”

Ellen smiled faintly, almost imperceptibly. This wasn’t revenge. This wasn’t theatrics. This was a check on a door she had locked decades ago—and the key was in her hand.

By the next morning, Brent Collins, the CFO, dismissed the clause as obsolete. “It was superseded in the 2014 comp restructuring,” he wrote. But Ellen had never signed that restructuring. She had documented her rejection. Every email, every timestamp, every notarized page ready to prove her case.

When Maline Lopez, a junior associate in legal, accidentally CC’d her on an internal review, it confirmed everything: the clause was active, enforceable, and the board’s oversight ignored decades of history.

Ellen leaned back, letting the quiet satisfaction settle in. The storm was coming—and it was going to be orderly, surgical, unstoppable.

Over the next few days, Ellen moved with calm precision. She assembled a complete digital and physical dossier: the 2001 board minutes approving the clause, her original offer letter from 1994, the notarized 2001 copy of the founders’ agreement, and her documented rejection of the 2014 compensation restructuring. Every piece of evidence was timestamped, encrypted, and cross-referenced. Nothing could be misinterpreted, nothing left to chance.

Meanwhile, Stratagrowth continued business as usual—or at least, it appeared so. Zoe, the young VP of strategy, bounced between presentations. Brent Collins clicked pens, smug as ever, pretending everything was under control. But beneath the surface, the tension was building. Meline, the junior legal associate, began quietly flagging every archived HR document and confirming enforcement potential. Vendor calls were delayed, and whispers of instability spread quietly through finance. The panic was subtle, almost invisible, but Ellen felt it like a pulse.

On a Wednesday, Ellen received an anonymous whistleblower tip: Brent had sent a legal memo stating, “Let her push it. She’s too old to fight this. We stall her out, she’ll cave or croak.” Those words were meant to intimidate her, but they only strengthened her resolve. Age was irrelevant; decades of work weren’t a liability—they were her leverage.

Ellen drafted a formal board notice: Clause 14D whistleblower evidence attached. She documented the CFO’s and legal team’s awareness of the clause, and the deliberate stalling in violation of internal ethics. Her email demanded confirmation of wire instructions and payout timeline. No threats. No drama. Just contractual enforcement.

By Friday, the atmosphere inside Stratagrowth had shifted. HR and legal departments went silent. Finance Slack channels were empty. Brent was gone, resigning under the guise of personal reasons, leaving a crater in liquidity that reverberated across operations. Vendors paused payments, payroll approvals stalled, and emergency investor calls began. The company was now scrambling under the weight of a single clause written decades ago.

Ellen, meanwhile, remained untouched by the chaos. She continued her routine: reviewing vendor contracts, approving purchase orders, and quietly observing the dominoes fall. She didn’t gloat. She didn’t celebrate. She just watched the ripple effect of decades of diligence meet a single, enforceable contract.

By Monday, the wire was overdue. Interest clauses automatically triggered. Compliance escalated notifications. The legal default was official. Stratagrowth’s CFO, board, and counsel were scrambling, trying desperately to negotiate a way out of the clause. But the contract was precise. Unambiguous. They had walked into a trap they didn’t see, all while underestimating the quiet founder they had tried to erase.

By the following morning, the $25 million wire—and accrued interest—hit Ellen’s account. The transfer was clean, unquestionable, and fully compliant with Clause 14D. Confirmation came through her attorney’s encrypted message: “Wire cleared. They paid every cent plus accrued penalties.”

Stratagrowth scrambled to issue a formal apology. Jeremy Hartman, the new CFO, sent a polite, carefully worded email: “On behalf of Stratagrowth, we sincerely regret the oversight and circumstances that led to this. Your contribution is immeasurable.” Ellen didn’t reply. What was left to say? Her signature had already been stamped into the company’s DNA—its policies, procedures, and digital infrastructure.

The stock price reacted quickly. Within five trading days, Stratagrowth lost 18% of its value, as investors recalibrated the risk of executive agreements ignored for decades. The board tried to contain the fallout, issuing statements about operational recalibration, but the damage was structural. Layoffs followed, 57 employees impacted. Ellen didn’t gloat; she understood that systems fail indiscriminately when leadership miscalculates. She simply had ensured her work, her legacy, and her rights were respected.

She retreated to her lakeside cabin, six hours away, no signal, no inbox, no chaos. The wind cut across the water, frost glinting on the shore. She lit the fireplace, opened her leather notebook, and flipped through three decades of lessons: names underlined in red, crises survived, boards navigated, and contracts enforced. On the last page, she wrote one line: They built the company on my back. I left with what I was owed. No more, no less.

Ellen Carter didn’t need fireworks to assert power. Quiet, precise, relentless enforcement of principle had been enough. The company would remember her—not for drama, but for the weight of a legacy they tried to erase.

And for those of you watching, learning, or just surviving your own corporate chaos, remember: systems forget, people forget, but paper never lies. If you liked this story, hit that subscribe button, leave a comment, and share it with someone who needs to see that even the quietest person in the room can make the walls shake. Because sometimes, the most powerful victories are invisible until the numbers show up.